The Monetary Policy Committee, citing

a decline in headline inflation

to 4.9% year-on-year in November 2024

Business Reporter

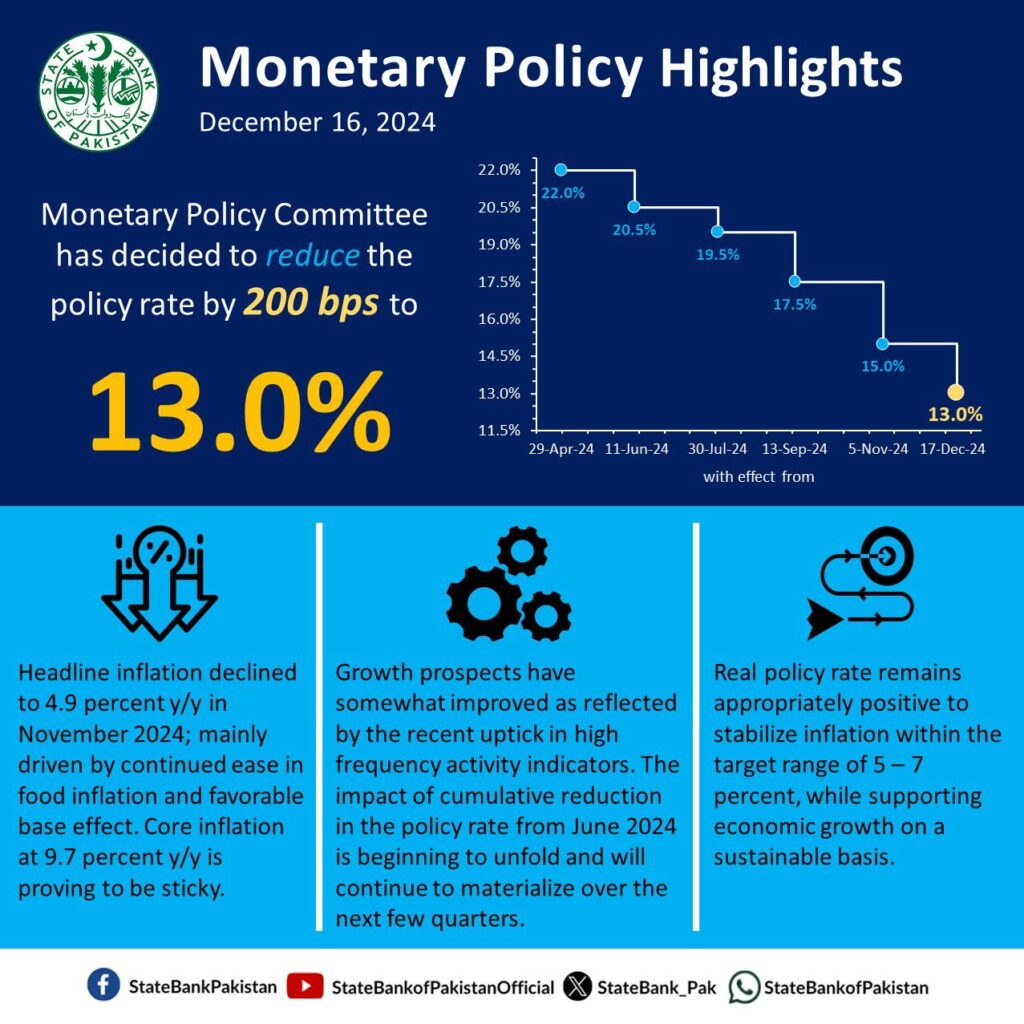

KARACHI, Dec 16, 2024: The State Bank of Pakistan (SBP) announced a significant policy rate cut of 200 basis points, reducing the rate to 13%, effective December 17, 2024. The Monetary Policy Committee (MPC) made this decision during its meeting, citing a decline in headline inflation to 4.9% year-on-year in November 2024.

The decrease in inflation was attributed to lower food inflation and the fading impact of gas tariff hikes from November 2023. However, core inflation remains at a sticky 9.7%, while inflation expectations among consumers and businesses are still volatile.

The MPC emphasized that the policy rate cut aims to balance inflation control with sustainable economic growth, noting improved growth prospects reflected in high-frequency indicators.

Macroeconomic Highlights

Key developments influencing the macroeconomic outlook include:

- Current Account: Surplus for three consecutive months, with SBP’s foreign exchange reserves reaching $12 billion by October 2024.

- Global Commodity Prices: Favorable trends have positively impacted domestic inflation and the import bill.

- Private Sector Credit: Notable increase in borrowing due to eased financial conditions and compliance with advances-to-deposit ratio (ADR) thresholds.

- Tax Revenues: Shortfall against targets, posing a fiscal challenge.

The MPC noted that the cumulative policy rate reductions since June 2024 are expected to further stabilize inflation within the 5%-7% target range over the coming quarters.

Economic Growth Outlook

The agriculture sector has shown resilience with better-than-expected cotton arrivals and promising wheat crop data. Industrial activity has also gained momentum, with strong growth in large-scale manufacturing sectors like textiles, food, and automobiles.

High-frequency indicators, such as sales of cement, autos, and fertilizer, suggest continued industrial expansion. The services sector is anticipated to benefit from reduced inflationary pressures and improving business confidence.

The MPC projects real GDP growth for FY25 to fall in the upper half of the 2.5%-3.5% range.

External Sector Developments

The current account posted a surplus of $0.2 billion during July-October FY25, supported by robust workers’ remittances and strong export performance, particularly in textiles, rice, and petroleum. Favorable global commodity prices and narrowing exchange rate gaps have further strengthened this position.

SBP projects that foreign exchange reserves will exceed $13 billion by June 2025, with the current account deficit expected to remain between 0%-1% of GDP.

Fiscal Sector Challenges

While fiscal operations improved in Q1-FY25, FBR revenue growth of 23% year-on-year during July-November remains insufficient to meet annual targets. On the expenditure side, lower yields will reduce interest payments on domestic debt, offering some fiscal relief. However, achieving the primary surplus target will require additional revenue measures and structural reforms.

Inflation Trends and Risks

Headline inflation dropped to 4.9% in November, driven by a favorable base effect, moderating food prices, and benign global commodity trends. The MPC revised its FY25 inflation forecast to substantially below the earlier range of 11.5%-13.5%.

However, inflation risks persist, including revenue-raising measures, potential food inflation resurgence, and global commodity price volatility. Despite these risks, the MPC considers the current monetary policy stance adequate for stabilizing inflation within the target range.

Conclusion

The SBP’s decision to cut the policy rate reflects a balanced approach to managing inflation and fostering economic growth. With improving external accounts, easing inflationary pressures, and strengthening industrial activity, Pakistan’s economic outlook shows cautious optimism as FY25 progresses.