The Pakistan Stock Exchange maintained its

record-breaking rally on Monday, fueled by

strong buying interest in the oil & gas sector

Business Reporte

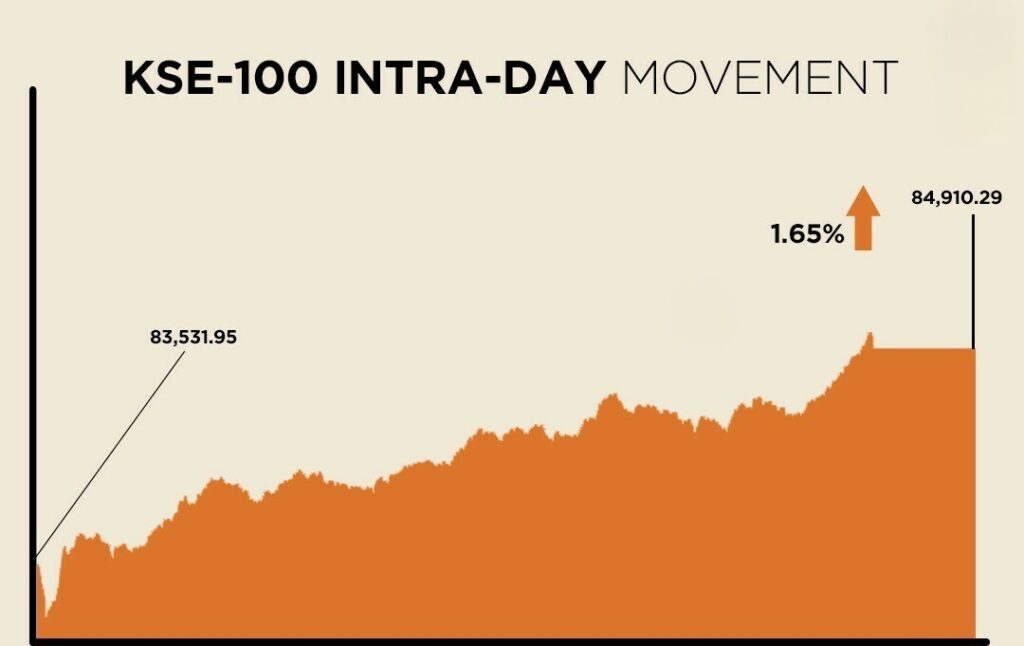

Karachi: The Pakistan Stock Exchange (PSX) maintained its record-breaking rally on Monday, fueled by strong buying interest in the oil and gas sector. The benchmark KSE-100 Index closed at a historic high of 84,910.29 points, marking an impressive increase of 1,378.34 points or 1.65%.

Market Activity

The trading session witnessed significant buying activity in index-heavy sectors, including automobile assemblers, cement, commercial banks, fertilizers, and oil and gas exploration companies. Major stocks such as OGDC, PPL, ENGRO, PSO, and SNGP all saw robust gains, contributing to the overall positive sentiment.

Experts attribute this surge in buying to improved macroeconomic indicators and expectations of an imminent policy rate hike. “Amid a decline in the inflation rate and money market yields, the market anticipates a potential policy rate decline of 150-200 basis points,” said Sana Tawfik, Head of Research at Arif Habib Limited (AHL). She added that this momentum is likely to continue, especially with the upcoming corporate result season expected to drive further interest.

Bullish Trend Despite Challenges

Interestingly, this bullish trend comes despite a recent surge in terror-related incidents in the country. A tragic attack on a convoy carrying Chinese staff from the Port Qasim Electric Power Company on Sunday near Karachi’s Jinnah International Airport resulted in the deaths of two Chinese nationals.

Last week, the PSX experienced a historic rally, crossing the 83,000 psychological level for the first time, with a week-on-week increase of 2,239.83 points. The index had closed at 83,531.96 points previously.

Global Market Influence

Globally, Asian stocks rallied, with Japan’s Nikkei leading the gains at 2% due to positive US labor data that eased recession fears. The MSCI Asia-Pacific index also rose 0.4%.

In the currency market, the Pakistani rupee saw a slight depreciation against the US dollar, falling 0.04% to settle at 277.64 in the inter-bank market.

Trading Volume

Trading volume surged on the all-share index, reaching 449.51 million shares, up from 381.53 million in the previous session. The total value of shares traded increased to Rs30.19 billion, compared to Rs20.52 billion earlier.

Market Summary

On Monday, shares of 448 companies were traded: 218 recorded gains, 167 faced declines, and 63 remained unchanged. Pak Petroleum emerged as the volume leader with 40.78 million shares, followed by Hub Power Co. XD with 28.08 million shares, and Fauji Cement XD with 23.13 million shares.