Bilwani noted that the SBP’s modest reduction

falls short of the business community’s demand

for a cut of 400 to 500 basis points

Business Reporter

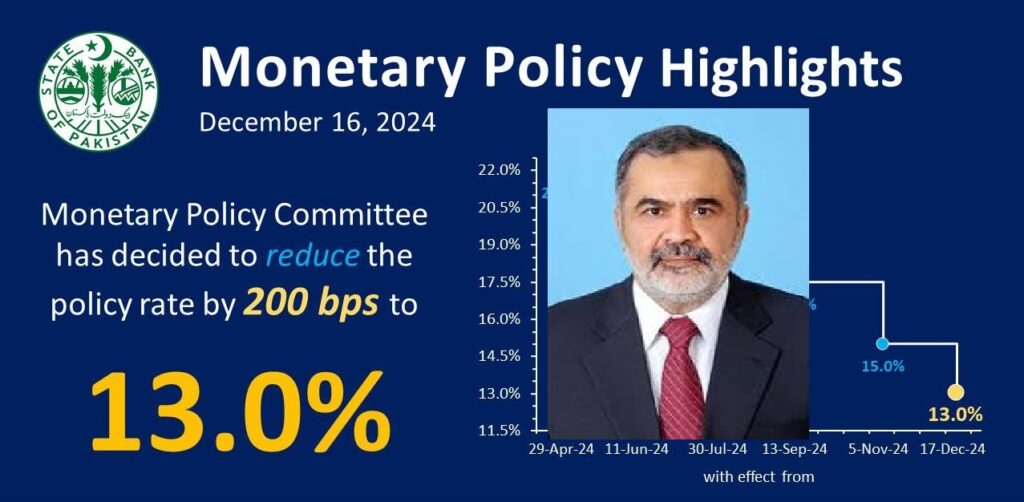

Karachi: The Karachi Chamber of Commerce and Industry (KCCI) President, Muhammad Jawed Bilwani, has expressed disappointment over the State Bank of Pakistan‘s (SBP) decision to reduce the interest rate by 2 percent, bringing it down to 13 percent. Bilwani noted that while inflation declined to 4.9 percent in November, the SBP’s modest reduction falls short of the business community’s demand for a cut of 400 to 500 basis points.

Call for Aggressive Rate Cuts

Bilwani emphasized that the current policy rate of 13 percent is still too high. He urged the SBP to adopt a more aggressive approach, reducing the interest rate to between 5 and 7 percent, aligning with regional economies such as India, Vietnam, and Bangladesh, where rates stand at 6.5 percent, 4.5 percent, and 10 percent, respectively.

He highlighted that lower interest rates would encourage borrowing, reduce business costs, and stimulate economic expansion, ultimately benefiting Pakistan’s economy.

Five Consecutive Cuts Acknowledged

Bilwani acknowledged the SBP’s ongoing efforts to ease monetary policy, with five consecutive cuts bringing the rate down from 22 percent to 13 percent. However, he called for a more significant reduction to mitigate the financial burden on businesses and consumers and boost economic growth.

Impact of Tight Monetary Policy

The KCCI president pointed out that the SBP’s tight monetary policy had resulted in exorbitant borrowing costs, severely impacting the manufacturing sector and other industries. He emphasized the need for substantial rate cuts to revive the economy.

“We hope the SBP will continue this trend and reduce the policy rate by at least 500 basis points in its next review,” he said.

Inflation and Economic Recovery

Bilwani attributed the decline in inflation to 4.9 percent not to SBP’s monetary policy but to global trends in commodity and oil prices, administrative measures by the government, and improved agricultural output.

He concluded by expressing optimism for further interest rate cuts, which he said would be a welcome relief for the business community struggling with the high cost of doing business.