Motiwala said the budget is built on unrealistic

targets and lacks practical strategies

for economic revival

Staff Reporter

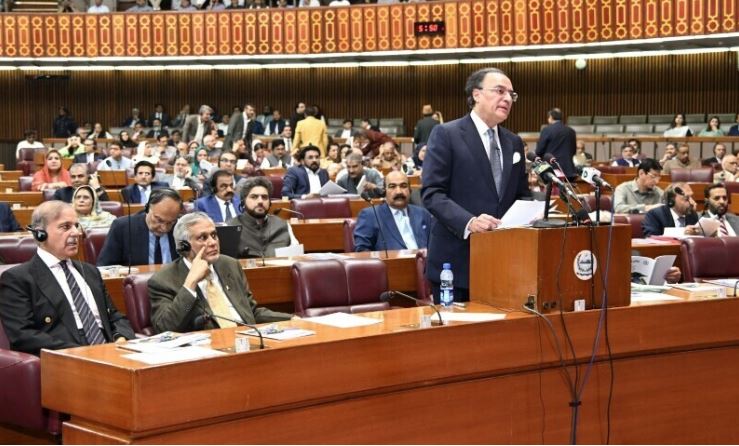

Karachi: Chairman of the Businessmen Group (BMG), Zubair Motiwala, has strongly criticized the Federal Budget 2025–26, calling it a “camouflage budget” that fails to offer meaningful relief to either the business community or the general public. Speaking at a press conference at the Karachi Chamber of Commerce and Industry (KCCI) following the finance minister’s speech, Motiwala said the budget is built on unrealistic targets and lacks practical strategies for economic revival.

No Relief for Industry, Unrealistic Economic Targets

Motiwala warned that the budget appears disconnected from economic realities, pointing out that the previous fiscal year’s major targets—GDP growth and fiscal consolidation—were all missed. Despite this poor performance, the government has raised its targets without offering a clear roadmap to achieve them amid a climate of economic uncertainty, high inflation, and IMF-driven restrictions.

While the budget includes announcements around digitalization and a shift toward a cashless economy, Motiwala argued these steps are insufficient to stimulate exports or drive industrial growth—two critical pillars for sustainable economic recovery.

Squeezing Compliant Taxpayers, Ignoring Reforms

The BMG chief expressed alarm over the government’s approach to achieving its ambitious revenue targets, saying it relies excessively on extracting more taxes from the already documented and compliant segment of the economy. Rather than expanding the tax net to include untaxed sectors, the budget threatens to increase the discretionary powers of tax officials—discouraging business activity and shrinking the formal economy.

No Measures to Reduce Energy Costs or Promote Exports

Motiwala also criticized the lack of incentives for export-oriented industries, especially the textile sector, which he described as the backbone of Pakistan’s economy. He said there was no announcement on reducing gas tariffs for industrial users, making Pakistani products uncompetitive in global markets. The absence of interest rate reductions further limits the potential for industrial expansion.

He stated that the budget offers no structural reforms or vision to foster a pro-business environment. “Instead of growing the economic pie, the government is merely reshuffling an already stagnant one,” he remarked.

Neglect of Karachi and Inadequate Infrastructure Investment

The Public Sector Development Programme (PSDP) allocation of Rs1,000 billion was termed inadequate, especially considering the urgent need to upgrade national infrastructure. Motiwala highlighted that only Rs2.783 billion was allocated for climate change initiatives—an alarmingly low figure for a country repeatedly hit by climate-induced disasters.

He also criticized the negligible support for long-pending infrastructure projects in Karachi, such as K-IV, questioning the government’s commitment to Pakistan’s economic hub.

Fear and Frustration Among Business Community

Vice Chairman BMG Anjum Nisar stressed the importance of a fair, transparent tax system that fosters confidence rather than fear among taxpayers. He said the current approach could intimidate businesses and suppress economic activity.

“Karachi is the economic engine of Pakistan,” Nisar said, “and instead of overburdening it with tax expectations, the government must invest in its infrastructure and policy support.”

Public Left in the Cold, Say KCCI Leaders

President KCCI Muhammad Jawed Bilwani outright rejected the budget, calling it disconnected from ground realities. “The government’s claims of reduced inflation don’t match what people are facing in their homes,” he said, citing unaffordable electricity bills and skyrocketing costs of essentials.

He lamented the absence of any concrete steps to reduce electricity tariffs or borrowing costs, both of which are vital to business survival and job creation. Bilwani said Pakistan’s over-reliance on IMF programs and foreign remittances is unsustainable and underscored the urgent need to develop a self-sufficient industrial base.

Call for Structural Reforms and Broader Tax Net

Bilwani concluded by urging the government to introduce structural economic reforms and broaden the tax net to include untaxed sectors. “Without these measures, there can be no long-term economic stability,” he warned.