The decision came after the Monetary Policy

Committee meeting, citing a notable decline

in inflation over March and April

Business Reporter

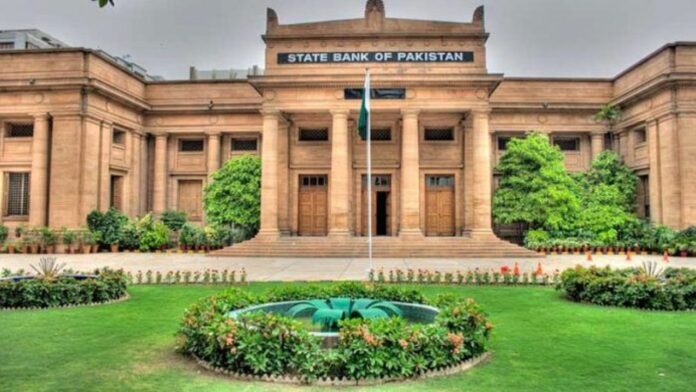

Karachi: The State Bank of Pakistan (SBP) slashed its key policy rate by 100 basis points to 11% on Monday, effective from May 6, 2025. The decision came after the Monetary Policy Committee (MPC) meeting, citing a notable decline in inflation over March and April.

Inflation Falls Sharply

According to the MPC, the rate cut was driven by a steep drop in headline inflation, largely due to lower administered electricity tariffs and easing food prices. Core inflation also declined in April, supported by a favorable base and moderate demand levels.

April’s inflation stood at just 0.3% year-on-year, down from 0.7% in March, while the current account posted a $1.2 billion surplus. SBP’s foreign exchange reserves rose slightly to $10.21 billion as of April 25.

“This cut is higher than market expectations,” said Mohammed Sohail, CEO of Topline Securities. “Most analysts anticipated a 50bps cut or no change due to global uncertainties.”

Market Divided Over MPC Outlook

Ahead of the meeting, analysts held mixed views. Arif Habib Limited expected a 50bps cut, citing disinflation and macroeconomic stability. However, Topline Securities and others forecast no change, pointing to IMF conditions and unresolved external inflows.

The policy rate was previously held at 12% during the last MPC meeting.

Rupee Weakens Slightly; Oil Prices Edge Down

Following the announcement, the Pakistani rupee depreciated by 0.4%. Meanwhile, global oil prices and domestic petrol rates declined, further easing inflationary pressures.

FPCCI Slams “Insufficient” Rate Cut

Reacting strongly, Federation of Pakistan Chambers of Commerce and Industry (FPCCI) President Atif Ikram Sheikh criticized the SBP for not reducing the rate by the 500 basis points demanded by the business community.

He said the 11% interest rate remains unjustifiably high compared to the Consumer Price Index (CPI) of 0.3%, maintaining a gap of 1,070 basis points.

“FPCCI had called for a 500bps cut in line with the Special Investment Facilitation Council’s (SIFC) goals and the Prime Minister’s vision for industrial growth, export promotion, and import substitution,” he said.

Oil Prices and Inflation Outlook Support Larger Cut

Sheikh predicted CPI to stay between 0–3% for May and June 2025 and argued that the interest rate should have been reduced to 7%.

FPCCI Senior Vice President Saquib Fayyaz Magoon added that OPEC+ recently announced an increase in oil output by 411,000 barrels per day for June 2025, pushing Brent crude prices down 3.9% to $58.9 per barrel.

“Geopolitical tensions, including those on borders with India, are unlikely to impact oil prices significantly. There was a clear opportunity for a deeper cut,” Magoon noted.